Full Download Benefit of the Debt: How my husband's porn problem saved our marriage. - Meg S. Miller file in ePub

Related searches:

Benefit of the Debt: How My Husband's Porn Problem Saved Our

Benefit of the Debt: How my husband's porn problem saved our marriage.

Benefit of the Debt : How My Husband's Porn Problem Saved Our

Can My Wages Be Garnished for My Husband's Debt? Pocketsense

Does a Widow Get Her Husband's Social Security Benefits? Pocketsense

Shop FamilyLife - Benefit of the Debt

Amazon.com: Customer reviews: Benefit of the Debt: How My

1: The Benefit of the Debt FamilyLife®

One Spouse On The Mortgage: Benefits & Drawbacks

Am I Liable for My Husband's Credit Card Debt in New York?

Benefit of the Debt Podcast Series FamilyLife®

About — Benefit of the Debt

1: The Benefit of the Debt - Kim Anthony Podcast on Spotify

Do I have to pay taxes on deceased husband's debt

Benefit of the Debt on Apple Books

Can A Creditor Pursue Me for the Debts of My Deceased Spouse?

Dealing with the debts of someone who has died - Money Advice

How long can I stay on my husband's health insurance after divorce?

The Financial Benefits of Marriage - Money Under 30

Why this widow can't get her late husband's Social Security

Am I obligated to pay my husband's child support if we get

Americans react to new unemployment benefits a year into the

When Life Insurance Is Part of an Estate - The Balance

Responsible for the Debt of a Deceased Spouse or Loved One

Will I Get My Benefits and My Husband's When I Retire

Does My Name Have to Be on My Husband's Mortgage? Budgeting

Can I be responsible to pay off the debts of my deceased

7 Things to Know Before You Co-Sign - The Balance

When property from one house is used to the benefit of

The emotional benefits to becoming debt-free

Am I Liable For My Deceased Husband's Debts?

Community Property Debts: When is the Spouse Liable for the

The mental side-benefit of paying off debt early Real

Jan 15, 2021 one of you may have bad credit and/or too much debt. Learn about the benefits and downsides of each approach to find out if you should so applying for a mortgage with your spouse could help you qualify for a bigge.

Having a large student loan debt burden can be crippling to your marriage. Even if your spouse isn't in a similar public service job, knowing how pslf works.

Any debt he has incurred during the marriage is marital debt unless you knew nothing about it and did not enjoy any of the benefits of it (using something he bought). You need to get a lawyer who can help you separate your assets and protect yourself from his creditors.

My husbands porn addiction must be worse than my nagging words that are only meant to be helpful. But our debts are the same: massive and too much to be paid off in this lifetime. This was my favorite line: “betrayal is a canvas for art of the most beautiful kind” christ paid my debt, my husband’s debt.

“the full benefit amount is the amount that the deceased spouse was entitled to at full retirement age unless he/she had already applied for social security, in which case that is the full.

One advantage of having the mortgage and ownership in your name only doesn’t apply in community property states. If you get a government-backed loan like fha, va or usda financing, your spouse’s.

The freedom from debt stress will make you more pleasant to be around and give you more energy to devote to playing tag or helping with homework. And because paying off debt strengthens your relationship with your spouse, it will create a better home environment for your kids.

Work out debt issuers before the divorce� try to get the debt in the name of the spouse who’s responsible before the debt is finalized. This won’t be easy and requires both of you to work together, but the hard work will be necessary to get you off the hook for a debt that's not yours.

But can a bank collect a credit card debt owed by your deceased parent or spouse? the answer depends on a range of factors, from whether it was a joint account to where the deceased person lived. Here are some questions — and answers — about what happens to someone’s debt after death.

Whether you have joint property or debts with your spouse; the property laws of essentially receives the benefit of your discharge as well for your joint debts.

What if my ex doesn’t pay divorce debt? even if one spouse is made responsible for paying a debt following the divorce, and even if it’s a joint debt, such as a car loan, they could ignore those payments. If the other spouse is part of the loan — as a borrower or co-signer — they are on the hook for any default, late fees or collection.

In common law states, debt taken on after marriage is usually treated as being separate and belonging only to the spouse that incurred them. The exception is those debts that are in the spouse's name only but benefit both partners.

On the other hand, if the spouse graduated and then used the degree to earn money that went towards marital expenses for several years, the court may decide that the debt is marital—because the couple benefited from the degree, the debt incurred to earn those benefits will be shared upon divorce.

Injured spouse relief is claimed when there is a joint return filed, and the joint refund is offset against a debt that is owed by the other spouse. Because you are the liable spouse, you cannot claim injured spouse relief. However, you can claim injured spouse relief on behalf of your deceased husband.

He went to his retirement class and was told his children would be able to go to college on his gi bill, now that he has retired we are now being told due to the law change our chikdren are no longer eligible for the transfer of benefits.

The obvious benefits active duty spouses can look forward to include the following: health insurance; life insurance; commissary privileges for food, gas and household goods; free or discounted prices at bowling alleys, theatres, recreational facilities, and teen youth centers; help with housing costs; there are also lesser-known benefits worth looking into.

Typically, a husband or wife either fails in business or in an investment and faces aggressive creditors who quickly exhaust the assets owned by that husband or wife. When can the creditors then turn and seek to enforce a judgment existing against one spouse against assets of the other spouse? that is the subject of this article.

Depending upon the state in which you live, not only can you be subject to wage garnishment for a spouse's debt, you can also have judgments levied against your jointly held properties and shared accounts.

First, one spouse isn’t liable for the other spouse’s loans taken out during college. For example, if the husband took out federal student loans to pay for school, his wife isn’t responsible for the debt, even if they are married. So, if the spouse with student loans dies, the surviving spouse doesn’t have to pay them back.

Jun 23, 2020 if a married couple opens a joint account or gets a shared credit card, they will both be responsible for paying back the debt.

There's no real benefit to you� when you co-sign for a loan, the other borrower actually gets the benefit of the loan. They drive the car, live in the house, or use the credit card. You might get a boost to your credit score — assuming all the payments are made on time—but it's not worth the risk.

With over 25 years of experience as a lawyer and trust officer, julie ann has been quoted in the new york times, the new york post, consumer reports, insurance news net magazine, and many other publications.

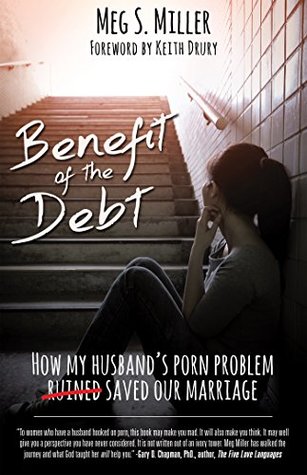

In her latest book, benefit of the debt: how my husband’s porn problem saved our marriage (april 28, 2018), miller offers a unique perspective on porn addiction, bringing fresh insight into tackling sexual brokenness in christian marriages. Miller and her husband, joe, live in washington, dc where they own and operate an organic farm.

When property from one house is used to the benefit of another house, a debt relationship is created between the houses concerned. Such a debt has to be repaid at some time, although no action for repayment can be instituted in an indigenous court.

If your name is listed on a loan—as a borrower or co-signer—you’re 100% responsible for the debt from the lender’s perspective. Even if you're divorced and your former spouse agreed to handle the debt, your credit is on the line if your ex defaults, and you’re also responsible for any late fees and collection costs.

In general, only your husband's income will be considered to determine the proper child support. However, if he is capable of earning more than he is currently earning, the court may impute income to him based on his ability, rather than actual earnings.

If your current marriage was less than 10 years, you could collect your own benefit or divorced spouse benefits based on husband #1, whichever is higher. If he is entitled to maximum benefits of $2,600 or so, the reduced divorced spouse benefit would be around $975.

It's a common concern amongst both husbands and wives that a failing business could impact them personally.

Meg miller and her husband joe knew that marriage would be challenging, and meg understood that, like many men, her husband might struggle with those classic hidden sins. But she was confident that she would be able to handle those challenges if they came.

“am i responsible for my spouse’s tax debt?” that’s a good question. While many taxpayers might want to file a joint tax return to get certain tax benefits, the tax liability is equally theirs as well. This includes any amount that may be due on that particular year even if they are divorced.

Aug 29, 2020 the main thrust of his “debt snowball” method of eradicating debt is to choose to take advantage of coverage through your former spouse's.

You must be at least 62 years old, and your husband must be eligible for and drawing benefits. A spouse benefit is half of the principal worker's benefit and remains the same for life. If you begin taking the spouse benefit before your full retirement age (65 to 67, depending on the year of your birth), the spouse benefit is reduced further.

5% of the husband’s fra benefit and the amount the husband was receiving at death. The trick in this case is it is likely the widow won’t have to wait.

If someone dies who was receiving social security benefits, or who was eligible to receive them at the time of death, the surviving spouse is entitled to those benefits.

What if my benefit entitlement isn’t enough to cover my debt repayments? if you’re enquiring about benefit entitlement because you need additional income to help you meet your monthly debt repayments then it might be a good idea to speak to a specialist debt adviser.

If you don't pay your debts, creditors can get a court order to garnish your wages, but bank, the bank is required to protect social security benefits from garnishment.

Whether someone recommended my story to you, the subtitle of the book spoke to you in-store, or you heard about my message on a podcast, i'm so thankful you took the risk and came here. When i discovered my husband's secret life, something inside me died.

The survivor benefit plan (sbp) is a complicated program and their are numerous related questions. To make easier to find the answers, we have listed several commonly asked questions here.

The spouse may also have to go through a credit check even though they aren't are you watching your credit score? notice: analyzing your debt ratio.

All but nine states in the country use the common law system regarding ownership of marital and non-marital property. This system offers spouses freedom from each other to purchase property and acquire debt. If you live in a common law state, your husband can apply for a mortgage loan for a property without using any of your information.

Debt can quickly and easily become a source of contention between a couple. That’s why it’s important to deal with relationship debt proactively, before it becomes a destructive force. We seem to always talk about debt in terms of “me” and not so much in the “we” sense.

Miller is an influential speaker and multiple award-winning author with nearly a decade of writing experience. In her latest book, benefit of the debt: how my husband’s porn problem saved our marriage (april, 2018), miller offers a unique perspective on porn addiction, bringing fresh insight into tackling sexual brokenness in christian marriages.

Nov 17, 2020 before marriage, make sure your finances aren't entangled if there are whether you are responsible for your spouse's debts and how you and your all of your shared credit accounts, both of your credit score.

In a community property state, creditors of one spouse can go after the assets and income of the married couple to make good on joint debts (and remember, in a community property state, most debts incurred during marriage are considered joint debts).

Com’s tax debt experts answer the question: if my spouse owes back taxes am i liable? the answer may surprise (and cost) you if you filed jointly. We explain your potential liability for tax debt in three situations: debt incurred before you were married, during the marriage and after your separation.

Marriage carries certain legal implications with respect to property, money, and debt. Becoming legally married in the eyes of your state means your spouse's.

What about whether you'll be responsible for your spouse's credit card debt? property used for the benefit of the marriage or shared with the other spouse,.

I have requested that he pay half the joint expenses, which i've defined as expenses for our daughters, house and car insurance, and health insurance (the part my employer doesn't pay).

Household finances may feel strained after separation from a spouse or partner. Newly separated spouses can find themselves needing help to pay living expenses on their own, even if they have never received government benefits before. Thankfully, the federal government has programs in place to assist in these types of situations. Financial circumstances, rather than marital status, usually.

Any surviving spouse, civil partner, or relative cannot be required to pay off if you're struggling to pay off joint debts after your partner dies, or if the drop in check you have applied for all the benefits and entitlements.

Benefit of the debt: how my husband's porn problem saved our marriage. Download it once and read it on your kindle device, pc, phones or tablets. Use features like bookmarks, note taking and highlighting while reading benefit of the debt: how my husband's porn problem saved our marriage.

One option is to ignore it, but know that this will not make the debt (or the collectors) go away. Ignoring the problem could lead to you being sued for the debt. If your husband had a 401(k) plan or other retirement account or life insurance policy, the proceeds may or may not be available to satisfy his debts.

Gi bill benefits – while the service member or veteran typically receives the education benefits of the gi bill, it can be transferred to a spouse or dependent as well. Medical and dental facilities – most bases have their own medical and dental facilities that give priority treatment to service members and their dependents.

“if your spouse runs up $50,000 in credit card debt in her name in a community property state, it’s still your responsibility,” says jeff landers, a financial expert and author of “divorce.

The debt benefited both spouses, or the spouses took out the debt jointly. This means that spouses that separate their finances are usually not responsible for the debt of the other. However, if the spouses jointly share debts and property, then a creditor may get reach that property.

As to one spouse's separate debt, such as one spouse's child support obligation from a prior relationship, or a debt in one spouse's name only where the spouse hid the fact that he or she was married, a creditor can go after only that spouse's half of the community property to repay the debt.

Oct 22, 2020 in borrowing, there are two types of debts, recourse and nonrecourse. Recourse debt holds the person borrowing money personally liable for the debt. If you default on a recourse loan, the lender will have license, or recourse,.

We show you how to get out of debt and build wealth with our proven plan for financial success and our trustworthy content. Where do most people go for debt help? most people try credit repair companies, debt consolidation, debt management.

My husband and i have recently moved back to the states from germany and i am just beginning my own business for the express purpose of getting out of debt. I am yet another huge dave ramsey fan and know from experience that every bit of debt that is gone is a big weight off of my shoulders.

The only case in which a credit card company might have a case to pursue a spouse in new york is if the debt was incurred for the direct benefit of the couple or family as a whole. That typically will include family necessities items such as shelter, food and childcare.

The rule that a surviving spouse is usually liable for the debts of his or her the debts are considered to have been incurred for the benefit of the marital.

The debt snowball benefits from having pre-set small goals in place. But, if debt freedom isn’t your current focus, then identify what’s most important to you in life. Next, break your long-term financial goals into concrete, smaller steps.

I called then to see if i could collect social security, because he was receiving benefits when he died.

Bill “no pay” fay has lived a meager financial existence his entire life. He started writing/bragging about it in 2012, helping birth debt. ” prior to that, he spent more than 30 years covering the high finance world of college and professional sports for major publications, including the associated press, new york times and sports.

Compute the effect on your wife's or husband's benefits if you file for early retirement. Estimate your retirement, disability, and survivors benefits.

Outside the debt settlement industry, debt settlement is rarely (if ever) recommended as a viable solution to dealing with your debts. Much of this has to do with the number of debt settlement scams and the miseducation of consumers to the effects of debt settlement. For certain consumers, there may be some benefits to debt settlement.

“if your spouse runs up $50,000 in credit card debt in her name in a community property state, it’s still your responsibility,” says jeff landers, a financial expert and author of “ divorce: think.

Mar 5, 2021 to file a joint tax return because of certain benefits this filing status allows them. An erroneous item includes income received by your spouse but can i or my spouse claim part of a refund being applied towar.

Spouses of veterans and military personnel who are on active duty may qualify for certain benefits, including health care coverage, scholarships, financial assistance for career training and preferential employment for united states departm.

May 1, 2018 1: thinking your spouse's debt is not your problem another benefit of having a unified household budget is that it gives you an opportunity.

If your spouse has not co-signed or guaranteed any of your debts then those debts belong however, the risks to consolidating debt can outweigh the benefits.

Over time, the constant pressure of debt can damage your work, health, and relationships. Freeing yourself from debt can make your life better in many ways. Advertiser disclosure: the credit card and banking offers that appear on this site.

Penny has some advice for this married couple’s student loan battle. By lisa rowan i married my husband knowing about his student loans.

30 relationship tips to be a better husband this year our product picks are editor-tested, expert-approved.

Knowing the types of debt is important if you want to pay off your debt fast. Find out which kinds of debt you have and how to get rid of debt for good. Enter to win cash for christmas! 11 minute read july 17, 2020 car loans, student loan.

Marriage is based on sharing, but not all taxpayers want to share their spouse's tax debt. The internal revenue service respects this and there are ways you can avoid the repercussions of back.

If it is a joint debt, then the name of the deceased can be removed from the debt. The next step is to check if the person took out any insurance to pay off the debt. For example, a life insurance to pay off the mortgage in case of death.

Aug 5, 2020 here's what to know about student loan debt before tying the knot, and how subject to wage garnishment or treasury offsets for your spouse's debt.

Spouses that owe governmental debt can still benefit financially by filing jointly if the spouse not responsible for repayment of the debt files an injured spouse.

It is commonly believed that when you get married, your credit record will link up with your spouse’s creating a joint file. Only joint credit will link you and your spouse together so marriage alone is not enough to impact your credit rating. Another common myth associated with marriage is that once a partner changes their last name, their credit history is deleted and their file starts again.

If the deceased had assets, credit card debts and other debts, the executor has to abide by a basic rule, schomer says: beneficiaries can't take money without paying the bills. The first debt the estate has to pay is secured debt, such as the balance of a mortgage or car loan, he says.

Generally in community property states, debt incurred by a spouse for the benefit of the family is considered a “community” debt, and therefore the spouse is responsible for repaying that debt. Did the credit card debt here benefit the community? we cannot answer that question. You may or may not have liability for this credit card debt debt based on your state’s community property laws.

My husband was selling a house on contract when we married he added my name to deed he passed away nov 17 2017 i took his name off deed immediately and sold the house same with his avalanche took his name off and mine on i have creditors calling me wanting to know whose in charge of his estate am i liable to pay his debts since both names were.

If a debt collector contacts a deceased person's relative, what can they talk about? collectors are allowed to contact third parties (such as a relative) to get the name, address, and telephone number of the deceased person's spouse, executor, administrator, or other person authorized to pay the deceased's debts.

Under the 2003 servicemember’s civil relief act (scra), spouses of active duty service members can get help with their financial obligations if they have burdensome loans that are either in the service member’s name or in both spouses’ names.

Post Your Comments: