Read 475 Tax Deductions for Businesses and Self-Employed Individuals: An A-To-Z Guide to Hundreds of Tax Write-Offs - Bernard B. Kamoroff | PDF

Related searches:

Amazon.com: 475 Tax Deductions for Businesses and Self

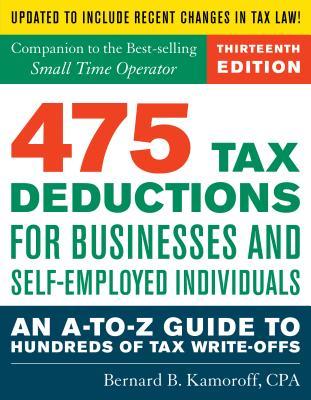

475 Tax Deductions for Businesses and Self-Employed Individuals: An A-To-Z Guide to Hundreds of Tax Write-Offs

475 Tax Deductions for Businesses and Self - Dailymotion

Business & Investing 475 Tax Deductions for Businesses and Self

475 Tax Deductions for Businesses and Self-employed

475 Tax Deductions for Businesses and Self- TaxConnections

9781589796621: 475 Tax Deductions for Businesses and Self

475 Tax Deductions for Businesses and book by Bernard B

9781589797987: 475 Tax Deductions for Businesses and Self

Free Download 475 Tax Deductions for Businesses and Self

475 TAX DEDUCTIONS FOR BUSINESSES AND SELF-EMPLOYED

Buy 475 Tax Deductions for Businesses and Self-Employed

475 Tax Deductions for Businesses and Self-Employed

475 Tax Deductions For Businesses - 13th Edition By Bernard

Frequently Asked Questions for I.R.C. § 475 Internal

Bernard B Kamoroff- 475 tax deductions for businesses

475 Tax Deductions for Businesses by Bernard Kamoroff

Tips For Traders: Preparing 2020 Tax Returns, Extensions, And

6 Top Tax and Bookkeeping Books for Small Business Owners

The Top Tax Deductions for Your Small Business Nolo

Business Tax Deductions and Credits

10 Ways to Reduce Your Taxes - Tax Deductions for Americans

Target™ - Turbotax For Business - Turbotax For Business at Target™

5 Books And Apps Every Small Business Owner Needs This Tax

Tax Time: 5 Accounting Books for Small Business Owners Inc.com

How Traders Get Enormous Tax Deductions, And Investors Do Not

15 Common Tax Deductions for Small-Business Owners

Want to pay less tax? - For traders & consultants.

Tax Deductions for Americans - 10 Ways to Reduce Your Taxes

Shop Turbotax For Business - Buy Turbotax For Business Today

Federal Tax Deductions For Businesses Who Donate to Charity

Ask for Tax Help Right Now - Get the Help You Need Now

Whatever the case may be, tax deductions are available to any business that donates to a qualifying organization. Money donation: one of the most popular forms of donation is a money donation. Businesses can donate any amount of money to a qualifying organization.

I would like to create a ebook styled essay that focuses as an accounting reference for anyone who works for themselves. Firstly, the intent is to provide a simple guide for business owners and also to appeal as a black owned business to black/minority owned businesses.

475 tax deductions for businesses and self-employed individuals: an a-to-z guide to hundreds of tax write-offs (422 tax deductions for businesses and self-employed individuals) - kindle edition by kamoroff, bernard. Download it once and read it on your kindle device, pc, phones or tablets.

475 tax deductions for businesses and self-employed individuals book. Read 5 reviews from the world's largest community for readers.

Com: 475 tax deductions for businesses and self-employed individuals: an a-to-z guide to hundreds of tax write-offs (9781589797987) by kamoroff, bernard and a great selection of similar new, used and collectible books available now at great prices.

The small business tax deductions you need to know while this list can help you prepare for an in-depth conversation with a tax expert, it does not replace the need for working with qualified bookkeeping and accounting professionals in order to keep your business on track and the internal revenue service (irs) or canada revenue agency (cra) happy.

If you have a business, you'll need to know something about taxes, the irs, and tax deductions. Learn about the most valuable deductions -- car expenses, business-related travel and entertainment, section 179 expensing.

Tcja introduced a 20% deduction on qualified business income (qbi) in pass-through businesses, and tts traders with 475 elections are eligible for the deduction.

Tax deductions and credits can help you save money on income taxes. Learn the difference between credits and deductions, and find out whether you can take advantage of credits for business improvements, energy efficiency, and more.

Tax deductions for home-based businesses may seem confusing, but they are an important part of saving money and putting more cash back in your pocket. We are an independent, advertising-supported comparison service.

475 tax deductions for businesses and self-employed individuals an a-to-z guide to hundreds of tax write-offs.

Feb 10, 2020 475 tax deductions for businesses and self-employed individuals: an a-to-z guide to hundreds of tax write-offs.

There is a newer edition of this item: 475 tax deductions for businesses and self-employed individuals: an a-to-z guide to hundreds of tax write-offs.

Oct 1, 2019 traders eligible for trader tax status deduct business expenses, startup costs, and home office deductions.

With 475 tax deductions outlined as potentially beneficial for small business owners and self-employed professionals, this book might be the ultimate collection to assist in business tax preparation. Read it cover to cover to familiarize yourself with all the deductions that a business could take or consult it when you have questions about specific topics.

475 tax deductions for businesses pdf updated 2019 – 2020 giving legal deductions is an important income tax strategy for small businesses. If certain operating expenses of a company are legally removed, your company may have less tax — sometimes much less.

If you're a homeowner, one of the expenses that you have to pay on a regular basis is your property taxes. A tax appraisal influences the amount of your property taxes.

475 tax deductions for businesses: bernard kamoroff: 9781493040186: paperback: taxation - small business book.

Taxconnections provides business development services for tax professionals, and access to trusted resources that best serve tax clients’ needs.

The 2018 tax reform law changed how deductions work for most taxpayers—including small-business owners.

Get this from a library! 475 tax deductions for businesses and self-employed individuals� an a-to-z guide to hundreds of tax write-offs.

Read reviews and buy 475 tax deductions for businesses - 13th edition by bernard kamoroff (paperback) at target. Choose from contactless same day delivery, drive up and more.

Mar 28, 2019 kamoroff has compiled a list of 475 deductions, from internet domain name costs to theft losses to entertainment expenses, plus which deductions.

Post Your Comments: